For years, the conversation around the “uninsurability crisis” was confined to the hurricane-prone coasts of Florida or the wildfire-scarred canyons of California. However, as we move through 2026, a new and more insidious trend has emerged: the “Inland Insurance Desert.” Driven by advanced AI-risk modeling and the increasing frequency of “convective storms”, which include devastating hail, straight-line winds, and inland flooding, major carriers are quietly blacklisting entire zip codes hundreds of miles from any ocean. This shift is catching thousands of homeowners off guard, as they find their premiums doubling or their policies canceled despite having no history of claims.

The data for 2026 shows that inland states like Iowa, Nebraska, and Tennessee are seeing some of the highest percentage increases in premiums nationwide. According to a report from the Insurance Information Institute, inland “secondary perils” now account for nearly 50% of all insured losses, leading many private carriers to simply walk away from markets they once considered safe. From the “Hail Alley” of the Midwest to the river towns of the Appalachians, here are ten inland cities that realtors and insurance brokers are now flagging as high-risk zones.

1. Des Moines, Iowa: The New “Hail Alley” Capital

Iowa has become the epicenter of a new type of insurance anxiety. In 2026, Des Moines residents are seeing a 28% year-over-year increase in homeowners’ insurance premiums, a spike driven almost entirely by the increasing severity of hail and wind storms. Realtors report that many national carriers have stopped writing new policies for homes with roofs older than ten years, regardless of their condition. This “roof age” mandate is stalling sales across the metro area, as buyers find they cannot secure a mortgage without an immediate, $20,000 roof replacement, a cost many sellers aren’t willing or able to cover.

2. Nashville, Tennessee: The Flash Flood Surprise

Nashville’s rapid growth is colliding with a geographical reality that insurers are no longer willing to ignore. The city’s “limestone basin” topography makes it incredibly prone to flash flooding, even in areas historically designated as “Zone X” or low-risk. Following a series of severe storms in late 2025, several major insurers have begun using “hyper-local” elevation data to deny coverage to specific blocks within East Nashville and Sylvan Park. Realtors warn that the “100-year flood” is now occurring with such regularity that the “standard” policy is becoming a thing of the past, replaced by expensive surplus-line coverage.

3. Omaha, Nebraska: The Severe Convective Storm Trap

Omaha is currently facing a “convective storm” crisis that has seen average premiums climb to over $3,800 annually. Unlike a hurricane, which provides days of warning, the straight-line winds and tornadoes that hit the Omaha metro can cause billions in damage in minutes. In 2026, data from the Nebraska Department of Insurance shows a 15% decrease in active carriers in the state. This lack of competition is allowing the remaining companies to hike rates and impose massive deductibles for “wind and hail” damage, often reaching 5% of the home’s total value, leaving owners with high out-of-pocket costs after a storm.

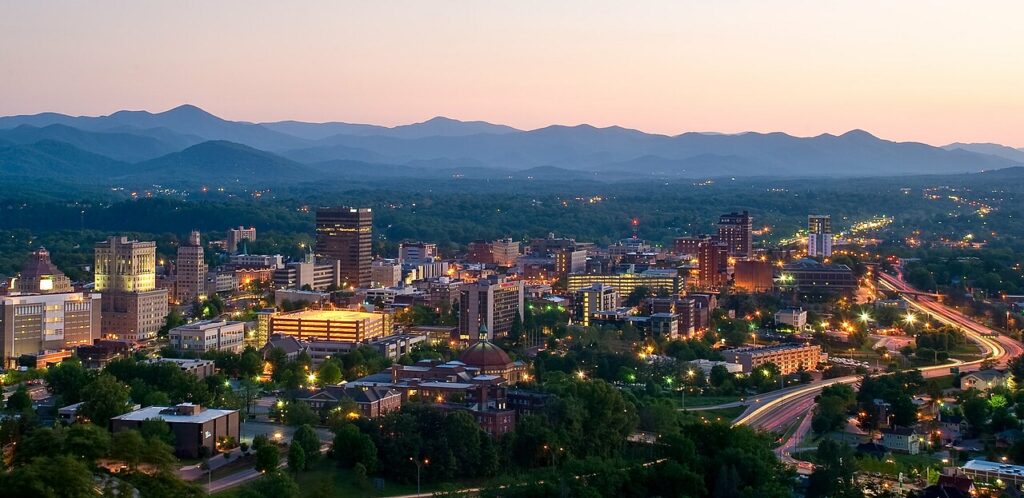

4. Asheville, North Carolina: The Landslide and Fire Frontier

Once considered a climate haven, Asheville is now seeing a “risk re-evaluation” by the insurance industry. The very mountain topography that attracts retirees is now a liability due to the increasing risk of wildfires and landslides triggered by heavy inland rain. Realtors in 32881 and surrounding zip codes are reporting that insurers are using satellite imagery to deny coverage to homes with “excessive brush” or those built on steep slopes. As a result, many “mountain retreats” are becoming uninsurable in the private market, forcing owners into the North Carolina FAIR Plan at double the cost.

5. Minneapolis, Minnesota: The Winter Storm Surcharge

While it may seem counterintuitive, the extreme cold and “ice dam” issues in Minneapolis are driving a localized insurance exodus. The cost of repairing water damage from burst pipes and roof collapses has skyrocketed due to the rising price of labor and materials in 2026. Realtors report that insurance companies are now “rating” Minneapolis homes based on the age of their plumbing and heating systems with unprecedented scrutiny. Homes built before 1950 that haven’t undergone a full mechanical overhaul are being flagged as “uninsurable” by mainstream carriers, creating a significant barrier for first-time buyers in historic neighborhoods.

6. Louisville, Kentucky: The Ohio River Erosion Zone

In Louisville, the threat is coming from the ground up. Increasing saturation levels along the Ohio River basin are leading to “foundation instability” and localized flooding that doesn’t always appear on federal maps. In 2026, realtors are seeing a trend where insurers are requiring mandatory “soil stability” tests before issuing new policies in certain riverside zip codes. This extra layer of bureaucracy and cost is cooling the market for what were once highly desirable river-view properties, as the “hidden cost” of protecting the home’s foundation becomes a permanent part of the monthly budget.

7. St. Louis, Missouri: The Infrastructure Failure Risk

St. Louis is dealing with a unique blend of “natural” and “man-made” insurance risks. The city’s aging combined-sewer system frequently overflows during heavy inland rains, causing “basement backups” that insurers are increasingly excluding from standard policies. Realtors warn that in zip codes like 63104, a “sewer backup” rider can now cost as much as the base policy itself. As the city struggles with a $1 billion infrastructure backlog, insurance companies are hedging their bets by raising rates or simply refusing to cover any property in a “backflow zone.”

8. Oklahoma City, Oklahoma: The “Tornado Alley” Premium Hike

Oklahoma City has long lived with the threat of tornadoes, but the 2026 insurance market has reached a breaking point. Following a record-breaking spring storm season, average premiums in the metro area have surpassed $4,500. Insurers are now implementing “mandatory storm shelter” requirements for new policies in certain high-risk suburbs. For sellers who haven’t invested in a reinforced safe room, the pool of potential buyers is shrinking, as lenders are becoming wary of financing homes that aren’t “climate-hardened” to the newest industry standards.

9. Boise, Idaho: The Wildfire “Smoke” Buffer Zone

Boise’s “High Desert” beauty is becoming a financial liability as wildfire risk moves closer to the city limits. In 2026, realtors are seeing “non-renewal” notices sent to homes in the Boise Foothills that have never even seen a flame. Insurers are now factoring in “smoke damage” and “evacuation liability” into their models. For residents in the 83702 zip code, finding a private insurer willing to cover a home near the “wildland-urban interface” has become a months-long process, with many forced to accept policies with limited coverage and astronomical deductibles.

10. Pittsburgh, Pennsylvania: The “Steep Slope” Liability

Pittsburgh’s famous hills are becoming a major insurance red flag. The city’s vulnerability to “landslips” and slope failure following heavy rain has led several major carriers to “geo-fence” certain neighborhoods out of their coverage zones. Realtors report that homes on “undesignated slopes” are increasingly being moved to the surplus-lines market, where premiums are 50% to 100% higher. This “geological tax” is quietly depressing property values in some of the city’s most scenic areas, as the cost of insuring the land becomes almost as expensive as insuring the house itself.

Leave a Reply